Wall Street’s at all-time highs. Bond yields are dropping like they see something terrifying in the distance. Gold is flexing like it’s 2011. And tariffs? Tariffs are raining down like glitter at a toddler’s birthday party.

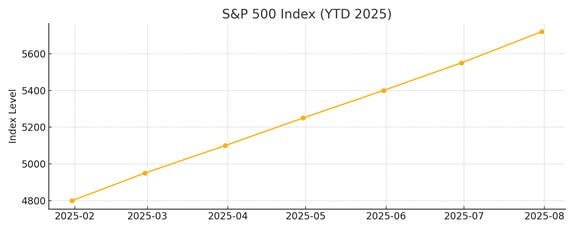

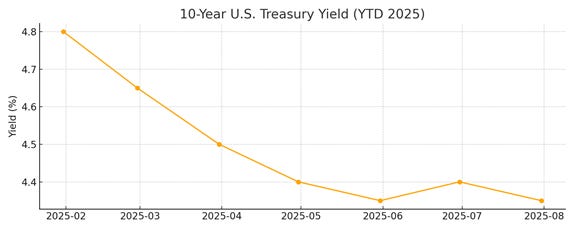

Welcome to mid-2025, where markets are doing their best impression of a split personality. Stocks are celebrating like it’s QE season, while bonds are screaming recession in Morse code.

**So what gives?**

On the surface, the latest tariffs—including a fresh 35% slap on Canada and blanket duties across the globe—haven’t fazed equities. Investors are too drunk on AI euphoria and the hope that Jerome Powell will cave and start a rate-cut parade. Meanwhile, bitcoin’s brushing $112,000 because apparently this is a video game economy now.

**But beneath the surface, it’s getting weird.**

- Bond yields are falling because growth looks anemic.

- Gold is up 26% YTD. That’s not optimism. That’s insurance.

- The dollar is down over 10%. (So much for King Dollar... now it’s more like Jester Buck.)

**And here’s the kicker:** Either stocks or bonds are lying. Possibly both.

Investors are quietly hedging like they know something’s going to snap. When it does, it’ll be fast, brutal, and maybe global.

Trump’s One Big Beautiful Bill is dumping $3.3 trillion into the deficit, just as tariffs threaten profit margins and consumers start gasping under higher costs. The second half of 2025 is shaping up to be a showdown: rate cuts vs. inflation spikes, optimism vs. hard data, YOLO bulls vs. reality.

But hey, if you’re day trading SPX options like I am, you don’t need to predict the war—just survive each battle. And if you want help doing that, my **paid Substack** delivers real-time analysis and strategy built for navigating exactly this kind of lunacy.

**Markets are cracking. Volatility is whispering. And someone’s about to be very wrong.**

Grab popcorn, keep your hedges tight, and maybe consider a little gold just in case.

- Binkus

Charts That Say It All

S&P 500 has powered to record highs... but not without anxiety:

Bond yields are flashing caution—hard on growth fears:

Gold? Rallying like it knows something we don’t:

Love the weekend ruminations. Your daily levels have never failed me yet. Thanks, Binx.