How to Break a Bond Market in Three Easy Tariff Hikes

What happens when you make foreigners pay your tariffs… by selling your debt

So, let’s imagine the U.S. imposes a lovely little 15–20% tariff on all imported goods. The political optics are amazing: tough on China, strong for the American worker, and best of all — foreigners pay.

Except… they don’t.

They pay by selling U.S. Treasuries — because, shocker, that’s where most of their dollars are parked. If they need dollars to cough up $500–$650 billion in tariff payments, they’re going to dump some bonds. And when they do, well...

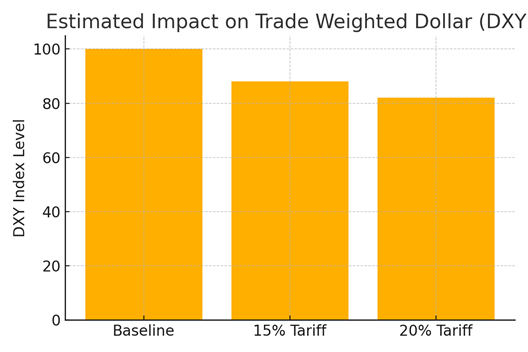

📉 The Trade Weighted Dollar: Death by Diversification

Here’s what happens when your biggest creditors decide they don’t need as many dollars:

The DXY falls faster than a meme stock with no Reddit support. We’re talking a 10–18% decline, putting us squarely in “dollar bear market” territory. Europe, Japan, and emerging markets rejoice… until they remember they still owe debt in dollars.

💣 Treasury Yields: Going Where the Sun Don’t Shine

Treasury prices? They go down. Yields? They go way up.

Every $100 billion in Treasury selling adds roughly 30 basis points to yields. With $500–$650 billion in forced sales, the 10-year spikes to 6.0–6.5%. That’s not just a tantrum — it’s a full-blown taper apocalypse.

🩻 S&P 500: Who Needs Risk Premium Anyway?

Stocks? Oh, they notice.

Between the inflationary impact of tariffs and the carnage in the bond market, equity valuations get hit hard. Rising rates crush growth stocks, the dollar slide boosts imported inflation, and suddenly, Wall Street longs for the peaceful days of... 2022?

🪓 The Feedback Loop from Hell

- Higher tariffs = foreign selling = weaker dollar

- Weaker dollar = higher inflation = higher Fed rates

- Higher rates = weaker equities = tighter financial conditions

- And repeat

It’s economic whack-a-mole, but you’re the mole.

🧨 What Could Possibly Go Wrong?

Everything. You’re trying to fund protectionist tariffs by blowing a hole in your capital account. It’s like asking your bank to finance your mortgage by canceling your credit score.

You’re breaking the dollar’s back, spiking your own interest rates, and fragilizing your stock market — all while hoping no one notices the irony of America’s debt-fueled consumerism being held hostage by its own tariffs.

🔚 In Conclusion:

If you want higher inflation, weaker growth, and a bond market that cries itself to sleep, tariffs are a great start.

But hey, if you’re into stagflation, liquidity shocks, and Fed panic attacks, stick around. We’ll be here, tracking the fallout.

Binkus! You are a brilliant writer! You are so smart and funny, everything you write is very educational and a pleasure to read. Thank you so much!!